When the move to renewables is discussed, much of the focus – understandably – tends to be around energy sources like wind and solar.

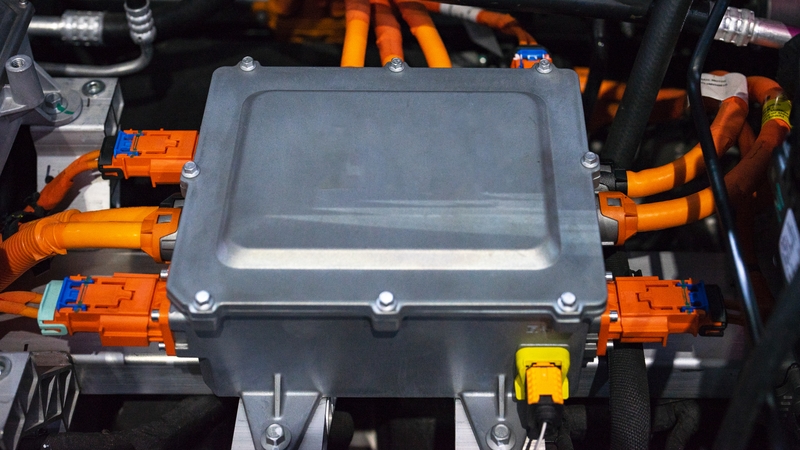

However the batteries required to store that energy is just as important.

That’s because you need batteries not only for electric cars, but also as a way of storing the excess energy that’s generated by wind and solar, which could then be used when the weather is less favourable.

That’s going to mean having massive battery arrays around the world – some of which are already being built in Ireland – while most homes will eventually having decent sized batteries of their own too.

And lithium is the favoured material for those batteries, meaning it could become the new oil in terms of its importance as an industrial resource.

And how much is there in the world?

There’s estimated to be around 88 million tonnes of lithium around the world.

South America has some of the biggest deposits – particularly Chile – but there are also significant deposits in Australia, China, Africa and some in North America too.

But, the problem is, only some of that is realistically accessible.

Just like with oil, it costs a lot of money to mine lithium – and if it’s in a harder to reach spot, or it’s a smaller deposit, then it would cost more to dig up than it’s worth.

So in reality it’s thought that there’s 22 million tonnes of lithium that’s actually worth mining.

And it is a finite resource, we can’t make any more.

So is that enough?

For context, there’s about 8 kilograms of lithium in a modern EV’s battery – so you’ll get a lot of cars made with those 22 million tonnes.

Really the more immediate concern is that we can’t get it out of the ground quickly enough.

Even when it’s economically viable to do so, building a lithium mine takes time, and money.

Given all of the emissions targets that are in place, a lot of which have deadline in or around 2030, there isn’t a huge amount of time for production to ramp up.

So you’d presume that the price of lithium is going up and up…

You’d think that would be the case – but it’s actually in the middle of a slump right now.

The price of lithium did spike in early 2022 – but it’s collapsed since then, and traders are still waiting for it to recover.

Part of the reason for the price falling is that production has been ramping up around the world – so there’s more supply.

But that’s been coupled with the fall in demand for electric vehicles.

That 2020 price spike was built on the rapid rise in EV sales globally, and the assumption that demand was going to just grow and grow. But this year we’ve seen it fall back.

It’s gotten so bad, in fact, that there are stockpiles of lithium in the supply chain waiting for a buyer - and that’s keeping downward pressure on prices.

In a way, that’s good news, because it makes the cost of manufacturing batteries that bit cheaper.

We have seen the cost of an EV battery continuing to fall in recent months, too. Given that the battery represents around 40% of the cost of making an EV, that’s a very important step in making such cars more affordable.

But the downside of the price being low is that it could discourage companies to expand existing mines, or set up new ones. They’ll feel it won’t be worth their while at the current price.

Most people still believe that we are moving towards an electrified future – so you’d assume it’s only a matter of time until the price of lithium starts to climb again as demand increases.

It just might take longer than some expect.

And is there ever a risk that we will run out of it?

Well, there’s a couple of factors at play there.

Some say there is a risk of us running out, others say that that’s just speculation on the part of traders who want to see the price increase.

But there are a number of reasons to be hopeful as to why we won’t run out for a very long time, if ever.

For a start, there are constantly being improvements made in the efficiency of batteries.

So while it takes around 8 kilos of lithium to make an EV battery now, in a few years’ time it might only be 6 kilos, or 4 kilos, or even less.

And one of the benefits of lithium is that it’s infinitely recycle-able – so as the EV market grows, and we have more reaching the end of their lifespan, we’ll start seeing more second hand lithium available on the market.

At the moment the cost of recycling or reclaiming the likes of lithium actually tends to be higher than it costs to mine new lithium – but that will likely change eventually.

Just as the use of lithium is getting more efficient, so are the recycling technologies.

And if we do start to get to a point where the supply of lithium starts to dwindle, or demand outstrips supply, that will probably make the market price go up, which will make recycling all the more attractive.

The market price going up, strangely enough, could also help to boost supply of new lithium too.

It may be the case that most of the lithium in the ground isn’t worth extracting at the moment – but if the price goes up (and mining technology gets more efficient) it could unlock a lot of what’s currently seen to be out of reach.

That’s what we saw happen with gas and oil a decade or so ago – with the explosion in shale gas and fracking.

They were relatively small deposits that weren’t worth digging for – until the technology improved, and the price hit such a point that doing so was suddenly profitable.

There were big environmental concerns with fracking – is it the same for lithium mining?

Yes.

This is one of the contradictions of the likes of lithium – and other raw materials like cobalt that are so important to batteries and electronics.

We need these resources if we’re going to have any chance of decarbonising our energy systems – but in order to get those resources, you need a lot of energy, and often a lot of water too.

You could potentially have renewable energy being used to mine – but realistically, it’s probably not going to be. Not at the moment, at least.

And then you have that large scale use of water – and all of the potential contaminants that comes from mining too.

The argument is that it’s for the greater good – but it’s still a tough one to stomach when it’s being done with the aim of going green.

Is there any alternative?

There’s a huge amount of money being invested into battery research at the moment – because anyone who can make a breakthrough in this could stand to make an incredible amount of money.

Part of that is about making constant, marginal gains on the technology that already exists.

But every few months there’s an announcement from a company, or a university, that a new battery technology is on the way that’s going to completely change the game.

So far, though, we’ve not really seen any of those turn into real world products.

The two big hopes are sodium ion batteries and solid state batteries.

Sodium Ion, as the name suggests, relies on sodium rather than lithium – which as a resource is much easier to find and extract and, so, less environmentally harmful.

They’re cheaper to make too, and safer; but they’re not as energy dense and they don’t last as long as lithium.

But one of the big stumbling blocks is that the industry just hasn’t been built up around the technology yet – and that can take a lot of time to develop, and probably relies on some companies to take big punts on making it happen.

There’s probably more hope around solid state batteries - which use a solid electrolyte, rather than a liquid one, to charge and discharge the ions.

In theory you can use any number of materials in that – so you could make one that’s more environmentally friendly than lithium (although lithium still seems to be the preferred material for some of the companies making the).

Solid state is also safer and more stable because it’s solid – and the indications are that it can be more energy dense too.

That means you would get a much more powerful battery in the same footprint as you would with lithium; or you could have the same energy, but in a smaller and lighter package.

And crucially for EV drivers – they can also charge up really quickly. Just five or ten minutes for a full charge, apparently.

The main stumbling block with solid state, though, has been figuring out a way to produce it at scale.

They are being produced today, but they’re confined to a limited number of high-end applications, because they’re effectively having to be made one at a time.

Toyota is one of the companies that’s been pumping huge sums into developing solid state batteries – but it’s only aiming to bring one to market by 2028.

And it’s not clear that they’ll be as easy to recycle as the lithium ion batteries that are being mass produced today.

And, critically, they’re going to be much more expensive to make – which means they’ll be far less attractive to people… at least until someone figures out how to make the process much more efficient than it currently is.