New figures from the Central Bank show that the number of home mortgage accounts in arrears of over 90 days fell by 2% in the first quarter of this year, mainly on the back of a decrease in the number of accounts in arrears between two and five years.

The Central Bank also said the number of accounts in long-term arrears - at least one year - stood at 20,258 - a fall of 1,757 accounts (8%) compared to the same time last year and a decrease of 10 accounts from the fourth quarter of 2023.

But the number of accounts in early arrears (less than 90 days) increased slightly, up just under 1% over the quarter, but down by 3% compared to the first quarter of 2023.

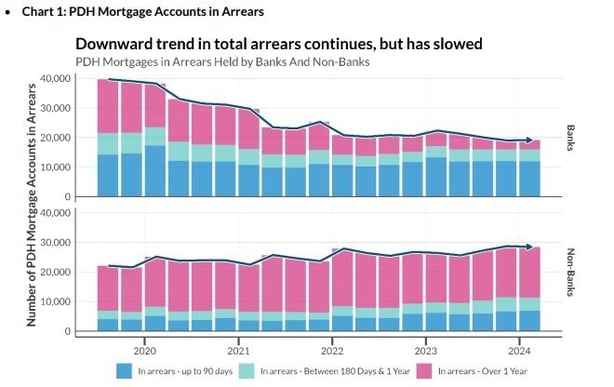

Today's figures show that 40% of home mortgage accounts in arrears were held by banks, while 60% were held by non-banks entities, unchanged from the last quarter.

The Central Bank said this compares to March of last year, where 46% were held by banks and the remaining 54% were held by non-banks.

Today's figures show a total stock of 55,533 home mortgage accounts were categorised as restructured at the end of the first quarter, representing 8% of total private dwelling house (PDH) mortgage accounts outstanding.

The Central Bank noted that the total number of restructure arrangements fell by 2,330 accounts over the quarter, which continues a long-term trend of decline.

Of the total stock of restructured accounts recorded at the end of March, 80% were not in arrears, while 84% were meeting the terms of their current restructure arrangement.

The main two types of restructured mortgages were split mortgage and arrears capitalisation arrangements -

unchanged from December 2023.

On buy-to-let mortgage accounts, the Central Bank said a total of 9,083 accounts were in arrears at the end of March, a decrease of 4% over the quarter and down 13% in annual terms.

Of the total number of buy-to-let accounts in arrears, 19% were overdue by between two and five, a further 17% were in arrears by between five and ten years and 16% were in arrears for over 10 years.

The Central Bank said that, significantly, non-bank entities held 76% of all buy-to-let accounts in arrears, 83% of buy-to-let accounts in arrears over one year and 84% of buy-to-let accounts in arrears greater than ten years.