RTÉ's Southern Editor Paschal Sheehy looks at why so many restaurants are closing and if measures to extend the deadline for payment of warehoused tax debts will be enough to save those still open.

The Government responded quickly this week to news of a wave of restaurant closures in the post-Christmas vacuum that haunts all businesses in the hospitality sector, once New Year's has come and gone.

This year's dry January appears to be particularly arid.

It is not an unusual time for food and drink-led businesses to close their doors, but the Restaurants Association of Ireland (RAI) claims that the number of its members which have shut down since Christmas has pushed the total number of closures over the last six months to more than 280.

These closures are across the country, with a variety of reasons being offered.

The closures appear to have gained particular traction in Co Cork, where there have been around a half a dozen since Christmas.

Tung Sing Chinese restaurant had been a staple on Patrick Street in Cork city for more than 60 years.

It was one of the first after Christmas to announce it was closing, citing increased running costs.

On the same day, Pigalle Kitchen on Barrack Street announced it was closing too.

A week ago today, the White Rabbit restaurant on MacCurtain Street announced that it was also closing.

"It has been a difficult decision to make but, as with other restaurants that have recently announced closures, the costs involved in running a full-service restaurant have become impossible to absorb," the management team at White Rabbit posted on social media.

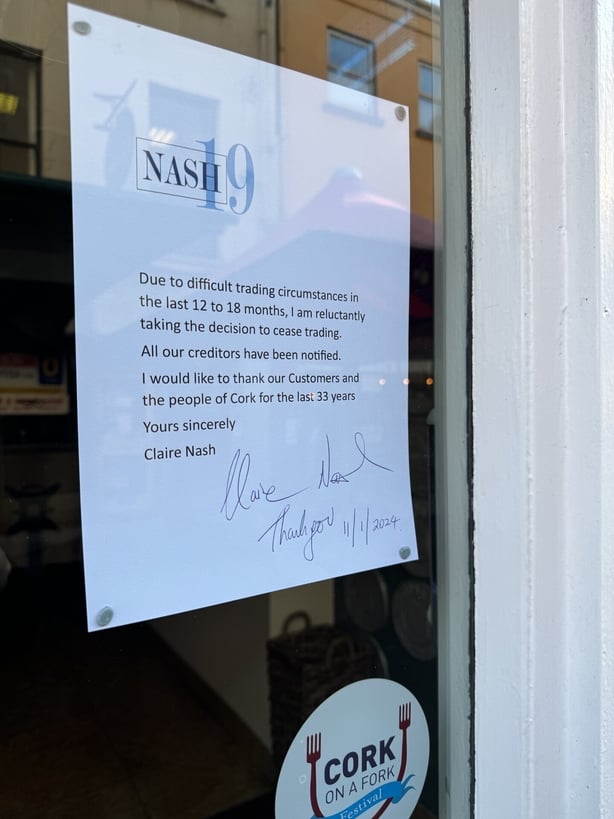

It was the closure of the popular Nash 19 that grabbed the most attention though.

The Irish Examiner felt it was sufficiently important to lead with the news last Saturday, with a front-page splash.

Claire Nash opened Nash 19 on 1 February 1991.

On 1 February 2024, 33 years to the day, she will be attending a creditors' meeting, marking its closure.

Nash 19 is on Princes Street in Cork, in between the commercial and trading heart of the city on Patrick Street and Oliver Plunkett Street, and the business and legal centre of the city on the South Mall.

Ms Nash, its owner, has been prominent in initiatives that put Cork on the culinary map, including Cork's Long Table Dinner, where 12 of Cork's restaurants and their chefs came together to prepare a four-course meal for 400 diners, seated outdoors on one long table on the South Mall.

Ms Nash was also a key figure in Cork on a Fork, a food festival which helped lift Cork out of lockdown restrictions in 2022.

It is the street dining model on Princes Street, outside her own front door, that Ms Nash is perhaps best known for, nationally.

In that case, several restaurants on Princes Street came together and lobbied Cork City Council for permission and support to agree to pedestrianize the street and install permanent, all-weather, outdoor dining facilities which the restaurants on the street serve.

It was a huge success, so much so that it is held up as a template for other towns and cities to copy.

In addition to all this, Ms Nash has been centrally involved in Cork Business Association (CBA).

None of the three senior Cabinet ministers in Cork were strangers in Nash 19, and they would certainly have known Ms Nash from her lobbying work for the city as part of the CBA.

This is a woman who successfully steered her businesses clear of two major floods in Cork city, when flood waters at least knee deep flowed in her front door on Princes Street, through the ground floor of her business and out the back door on Marlboro Street.

In addition, there would have been less significant floods once every two years or so.

"Claire Nash has been a driving force in business and the city for 33 years...and we are heartbroken and devastated that she has to close."

Ms Nash changed her business model and kept her head above the flood waters to navigate her way back to dry land.

She steered her way through the Covid-19 pandemic too. She has shown herself to be resilient, a survivor.

To say, therefore, that people were taken aback at the news that Nash 19 had closed and liquidators had been appointed to the company is an understatement.

"We are shocked and absolutely saddened to hear of the closure of Nash 19," CBA President Kevin Herlihy said.

"Claire Nash has been a driving force in business and the city for 33 years...and we are heartbroken and devastated that she has to close," he added.

Tánaiste Micheál Martin described Nash 19 as an institution, and Ms Nash as a force of nature.

He blamed the closure on "the long shadow of Covid" and promised that the Government would take action.

Speaking to RTÉ News on the day she confirmed the closure of Nash 19 a week ago, Ms Nash said that business, right up to Christmas, had been very good.

But, she said the costs of running a business, coupled with the dark cloud of the warehoused tax debt, left her with no alternative.

The tax debt warehousing scheme was introduced during the pandemic as a measure to help under-pressure businesses with cash flow.

It allowed them to warehouse tax they owed to Revenue for a period, providing vital liquidity to many.

"It looked like I was busy, and I got very busy at Christmas, really busy, but then you fall off a cliff in January and February," she said.

She questioned whether the system, the business model itself, is broken, particularly in the case of the restaurant sector.

"When you would put in a line entry that your light and heat and power was greater than your rent, you have a problem," Ms Nash said. "The definition of doing business in Ireland doesn't stack up. It's broken."

For 21 years, Richard Jacob ran Idaho Cafe with his wife Mairead on the corner of Caroline Street and Maylor Street in Cork city centre, not too far from Nash 19.

The Idaho Cafe was equally decorated and popular, but last February, Richard and Mairead reversed out of the restaurant business "before all the madness began".

The couple are now running online platform Style Barn which sells 100% sustainable goods.

Mr Jacob has the benefit of a longer perspective, a more detached view on what is currently happening in the restaurant sector.

He explained why it seems restaurant prices are increasing and asked if the Government is prepared to provide support and if the public is prepared to pay more.

"We need cafes, restaurants and hostelries in order to meet, to share ideas, to laugh and to mourn, we always have and we always will," Mr Jacob wrote in a piece for the Irish Examiner, as the first of these restaurant closures made their way into the news.

Warehoused tax debt a 'ticking time bomb' - Richard Jacob

He said staff costs in restaurants will have jumped by roughly a third over the past year, due to increases in the minimum wage and employer's PRSI, as well as changes to sick pay and pension entitlements for staff.

He said: "Using average staff cost percentages, this means that the average restaurant will need to increase prices by 15% just to cover this pay increase.

"A €3.50 coffee becomes €4. An €18 pasta dish is suddenly €20.70.

"The restaurant is not making any extra profit but is seeing turnover drop as the prices rise."

Mr Jacob described the issue of warehoused tax debt due to the Revenue Commissioners from the hospitality sector as the elephant in the room.

He said it is "a huge ticking time bomb" that will also affect other sectors too.

"The problem is that all of the factors above have eroded profitability to the extent that many businesses simply now cannot afford new repayments (the warehoused tax debt)," he said.

"The Department of Finance is in an unenviable position. They cannot simply write off the debts, because those businesses who did pay those taxes will effectively be penalised."

Ms Nash raises an equally fundamental point about what happens if the wave of closures continues unabated.

She asked: "My big question to them (the Government) is, you're pouring money into Tourism Ireland and Fáilte Ireland. That's fantastic, because we need it. But what are you actually selling? What are you marketing?

"Are you happy to market hollowed out towns and cities and experiences that mean nothing, a soulless experience?

"Is that what they actually want? Have they thought about how bad it is? I don't think they have. I heard that they didn't realise things were that bad."

Govt consider extending deadline for warehoused tax debt payment

Of course, this is anything but a Cork phenomenon.

Local media throughout the country have been recording similar closures in their areas for several months.

Even taken together, these do not confirm or corroborate the figure of 280 closures nationwide of restaurants and food-led businesses in the last six months, as claimed by the RAI.

But they certainly lend credence to the RAI figure.

All these closures appear to have provoked a Government response.

On Monday, after an event at University College Cork, the Tánaiste indicated that the Government would be prepared to consider extending the deadline for payment of tax debts which were warehoused during the Covid-19 pandemic in order to help those who were struggling in the restaurant sector.

Some details quickly followed from Minister for Finance Michael McGrath.

"We are going to make some changes to the tax warehousing regime with a view to being as flexible as we possibly can," Mr McGrath said.

He provided figures for the scale of the warehoused taxes and the size of the problem it represents: €1.75 billion is currently owed by 57,000 businesses under the tax warehousing regime.

This represents a significant reduction from a peak of more than €3 billion owed by 110,000 businesses in January 2022.

However, as Revenue claws back more and more of the tax due, the job of doing so will become increasingly difficult.

Clearly, those who can pay will, and have, and those who cannot pay will not.

"A lot of progress has been made, but we are really anxious to ensure that viable businesses are supported," Mr McGrath said. "We will seek to introduce enhanced flexibilities to make sure that these businesses can remain in operation."

The question is: Will this be sufficient to stave off closure for other restaurants for whom liquidation and closure is now looming?

"No, absolutely not," is the blunt reply from Adrian Cummins, Chief Executive of the RAI.

The RAI succeeded in carving out a profile for itself during the lockdown measures that accompanied the Covid-19 pandemic.

It put a focus on the sector and the difficulties it faced.

Ireland facing tsunami of food-led business closures - Adrian Cummins

Some might say the amount of airtime which spokespeople garnered for the sector during Covid was disproportionate, but the RAI will not see this as a criticism, even if it is intended that way.

For instance, recent publicity might have created the impression that the restaurant sector was the one which availed of tax warehousing arrangements more than any other, but this isn't the case.

Of the 57,000 businesses in the tax warehoused scheme, most are in the construction sector.

Nevertheless, struggling restaurants are now front and centre and, not wishing to waste a good crisis, the sector's representative voices are looking to make gains.

Mr Cummins is warning that the wave of restaurant closures will develop into, in his words, a tsunami of food-led business closures, unless the Government announces "a suite of measures" to provide support.

The current 13.5% VAT rate appears to be particularly in his focus.

The rate was increased from 9% to 13.5% last September after the RAI fought, and lost, a battle to keep it at the lower rate.

Given the current attention on restaurant closures, sector representatives are coming again.

The RAI welcomed the flexibility being offered by Mr McGrath on the repayment of warehoused tax debts, but said it wants more.

"There has to be a number of measures in terms of a reduction in the VAT rate from 13.5% to 9%," Mr Cummins told RTÉ News.

"That's very clear now, that that is the only way for our industry to become viable into the future," he said.

When the VAT rate was restored to 13.5% last September, Mr McGrath was insistent that it was going to stay there, irrespective of the campaign run by the RAI for the retention of the lower rate.

This weekend, a source close to the Government confirmed that there was no softening of its stance on that front.

"The 9% VAT rate served its purpose. It is not going to be re-visited," the source insisted.

"There is absolutely no likelihood of a change to that."

As many weigh up in the months ahead if they have a future in the restaurant business, it seems it is here that the battle lines will be drawn between the sector and the Government.