Analysis: we should consider such factors as ease of movement between providers, increasing broadband speed and falling prices

Broadband access has become a near-necessity in our modern world, an importance reinforced by the Covid pandemic. We need it for economic development, education, healthcare and social inclusion. In Ireland, the broadband market is dominated by a few large players. Although internet access and customer choice appear to be on the rise, they've been heavily influenced by government policies.

Who is looking after consumers?

Given the small number of players in the Irish broadband market, misbehaviour is a real concern, and fines are often imposed by ComReg, the Commission for Communications Regulation. For example, Eir received fines for a policy that prevented customer complaints, overcharging around 76,000 customers an excess of around €6.7 million and for non-compliant contract changes. Another provider Sky was recently fined for lack of disclosure

In December 2023, ComReg and the European Commission decided that the physical infrastructure access market should be subject to ex-ante regulation (i.e. before infringements occur). This decision required showing that "the market structure does not tend towards effective competition". Understanding whether the market is competitive (and at what level) is challenging but important.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

From RTÉ Radio 1's Morning Ireland in Sep 2023, Minister for State Ossian Smyth discusses the progress of the national broadband rollout

Who are the main players in Ireland?

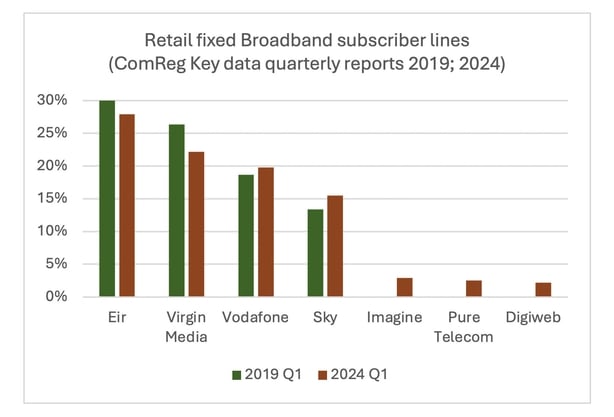

Ireland has four main broadband providers, most of which have had relatively stable market shares over the last six years.

Eir is the largest player and resulted from the privatisation of Telecom Éireann in 1999. Privatising key networks can have mixed effects, and it is often a bad idea in the absence of incentive-based regulation and restructuring. Eir was leveraged by new owners borrowing heavily while taking dividends out. When nationwide broadband needed to be developed and Eir was unable to finance it, the Government had to do it.

Eir's physical infrastructure of ducts and poles is the largest fixed network nationally and is used by other providers, so its actions directly affect market competition. ComReg's decision found that (only) Eir has "significant market power" in the physical infrastructure market, and the firm is now under several obligations to ensure effective and efficient wholesale access to this market.

How much competition is desirable?

Having more suppliers in the broadband market can have two effects: (1) firms become more efficient and innovate to discourage customers from switching to rivals - this benefits consumers through better product availability and/or quality; or (2) given the huge investment needed to improve quality, its incremental benefit may increase to the point where it becomes unprofitable. Whichever effect dominates determines how much competition is desirable in the broadband market.

In markets like broadband, concentration metrics such as market shares are usually poor predictors of competitiveness and there are some alternative ways of examining competitiveness in the broadband market. For example, ideally, one should see that more households over time have internet access; they are served by multiple providers so that they are easily able to switch; and broadband speed increases while prices decrease.

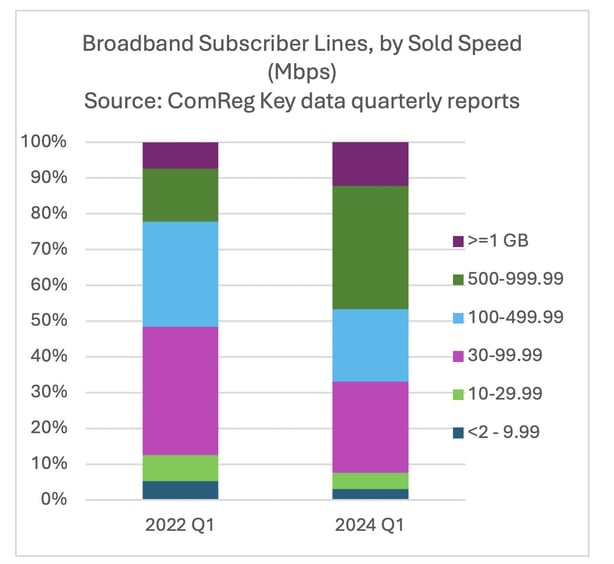

There are around 1.66 million active broadband subscriber lines in Ireland. Given the CSO's estimate of approximately 1.8 million households in 2022, it is likely that a large share of Irish households has broadband access. The number of high-speed subscriber lines has increased significantly in the last few years. As of 2024, 46.7% of lines have a speed of over 500 Mbps, up from 22.2% in 2022.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

From RTÉ Radio 1's Today with Claire Byrne in February, Charlie Weston, Personal Finance Editor with The Irish Independent and Dr. Nat O'Connor from Age Action on the increase in price for broadband services by some providers

The ability to choose between multiple providers is a key indicator of competitiveness. Rural areas are particularly affected by the "digital divide", as investments are harder to recoup, and thus sparsely populated rural markets have relatively limited broadband access, in terms of quality and providers. On this, the National Broadband Plan aimed at providing fibre to rural and underserved areas is helpful.

Between 2020 and 2023, the average price of the cheapest broadband package, weighted by changes in disposable income, increased by around 5.6% for low-speed internet, but decreased by about 9% for high-speed internet. This is a significant decrease.

At a glance, the above suggests that broadband speed increased, while prices have not increased substantially, but let's dig into this a little.

First, there have been many fines for breaches in the broadband sector. Unless consumers can and are willing to – given that consumer inertia is a big issue - easily switch providers, the large market players have an obvious incentive to engage in excessive pricing behaviour.

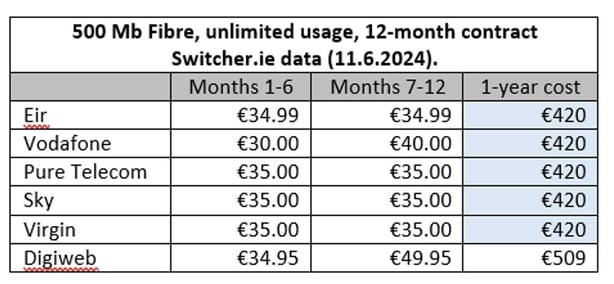

Second, Eir was deemed to have "significant market power" in the physical infrastructure access market. However, in the retail market, the yearly cost of a 500Mb (and similarly 1GB) broadband package is identical across most networks (for switching consumers).

Finally, most providers now have a built-in price increase in new contracts, which tends to be a fixed percentage or an increase according to the Consumer Price Index (CPI). While this increase happens automatically, it is not clear that customers can anticipate its amount. It may be challenging to find the base price on which to calculate the price increase and not all customers will be comfortable with calculating percentage and percentage point increases.

However, the similarity in broadband prices makes it difficult to assess where these prices stand in comparison with the competitive benchmark. Furthermore, misbehaviors continue to occur, and the dominant market players have an incentive to engage in excessive pricing practices, driven partly by consumer inertia even when switching is available. As new regulations are imposed on Eir, it will be interesting to see if (and how) the market changes.

Follow RTÉ Brainstorm on WhatsApp and Instagram for more stories and updates

The views expressed here are those of the author and do not represent or reflect the views of RTÉ