Female representation on the boards of financial services firms rose to 39% at the start of this year, from 35% in 2022.

The data relates to companies that have signed the Women in Finance Charter, which aims to improve female representation in financial services firms here.

91 companies with 65,000 employees have signed the charter since 2022.

This accounts for around half of all employees in the financial services sector.

Ten of the firms only signed up this year, and so haven't been included in the results.

Today's annual report outlines the progress companies have made towards increased gender balance.

Progress made

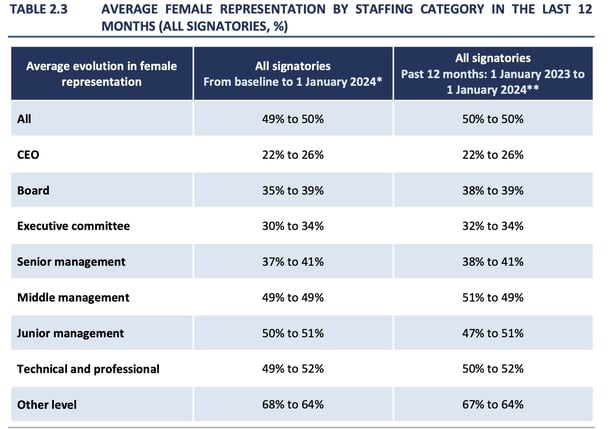

Among the 56 companies who joined the charter in 2022, female representation on executive committees increased to 37%, from 33% in 2022.

25% of the CEOs in these firms are now female, up 4% since 2022.

Female representation at senior management level increased from 39% to 41%, while representation at middle management level rose from 47% to 49%.

However, the figures show that female representation at junior management level decreased from 53% to 50%.

Speaking on Morning Ireland, Dr Helen Russell, research professor at the ESRI and one of the authors of today's report said the fall at this level isn't a concern at the moment.

"We would want to keep an eye on that though," she said.

"Those junior management level jobs are the pipeline for promoting people up to the more senior level, so it is important that this level remains gender balanced," Dr Russell added.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

Among new signatory firms, changes were tracked between January 2023 and January 2024.

The report shows that female representation increased at board level from 38% to 40%, while representation at executive committee level rose from 23% to 25%.

Representation at senior management level rose from 33% to 40%, but fell at middle management level from 53% to 51%.

Among these companies, representation at junior management level increased from 43% to 52%.

Across all the companies signed up to the charter, female representation across all jobs only increased slightly from 49% to 50%.

Targets set

A total of 200 targets were set by 78 signatories.

The higher the occupation level, the greater the number of targets set.

Today's report shows that most short-term targets have been met, and most medium and long-term targets are on track to being met.

"Setting targets and publicly communicating progress is an effective means of influencing change within organisations," said Dr Russell of the ESRI.

"The targets set by signatory firms are ambitious and have the potential to influence the opportunities facing women in the financial services sector in Ireland.

"The report provides examples of what is working within firms to promote greater gender equality, which may be useful for organisations in the wider economy facing the same issues," she added

Actions to improve gender balance

The companies that signed the charter were asked to choose the actions they had found most effective for improving gender balance.

In last year's report, flexible working was the most common action highlighted by firms.

However, this year's report has found that more than a third of all companies believe that female career development and leadership training are the most effective actions to improve gender balance.

Companies also said better gender balance in succession planning, improving flexible working, developing programmes for females in middle and junior management, and identifying female leaders were also effective actions.

In terms of the main barriers to achieving gender balance, companies cited low turnover and the low number of female applicants.

Working conditions

The report states that flexible work practices may promote greater gender balance, but only if they are available at all levels of the organisation and if they are taken up by both men and women.

If flexible options are confined to lower-level positions, the report states that this can reinforce the concentration of women at these levels.

Remote working practices have now become a standard approach across the companies that have signed the charter, and almost all operate a hybrid work policy.

The most common pattern is a minimum of two days a week in the office, which was reported by 37% of firms.

Meanwhile, a high proportion of the companies operate 'family-friendly' policies.

91% offer maternity benefit payment top ups, 88% offer paternity benefit payment top ups, and 85% offer extended leave schemes.

The Women in Finance Charter is supported by Government under the 'Ireland for Finance Strategy'.

The Minister of State for Finance with responsibility for Financial Services, Credit Unions and Insurance, Neale Richmond said today's report shows that the financial services sector is becoming more diverse.

But he said there is more work to be done.

"The Irish financial service sector is performing very well, now is the time for the industry to lead by example, for signatories of the Charter to continue their vital work and for the remaining firms, be they small, medium or large, to now follow suit, sign up to the Charter and build on the progress we see in today’s report," he said.